Time to Back Yourself:

Time to Back Yourself:

Why Medical Insurance Matters More Than Ever for Coaches

You coach others to perform at their best. But when it comes to your own health, are you walking the talk?

As Te Korowai’s insurance partner, we’re here to support your performance — by helping protect what matters most: your health, your income, and your whānau.

Let’s Talk about the Public Health System

Data shows it’s taking longer to access medical care in

New Zealand. No surprises there. The media is frequently covering news items on the growing pressure on our public health system.

The fact of the matter is that a delay in accessing medical care when you need it can significantly impact your health outcomes, quality of life, and ability to keep doing the work you love.

As coaches, mentors, and leaders in your own fields, you know the value of showing up consistently — both mentally and physically — for the people you support. But too often, we see people delay treatment because they feel they don’t have options, or they can’t afford the upfront cost. Medical insurance helps remove that barrier and puts you back in control.

Did you realise how critical access to healthcare is getting?

- A recent RNZ-Reid Research poll found that one in three New Zealanders are waiting more than two weeks for a GP appointment

- Over 74,000 patients were waiting more than 4 months for their first specialist assessment as at February 2025, a significant increase in just a couple of years

- The number of patients waiting longer than 4 months for treatment has also increased in the last 2 years alone

- Well over a third of the adult population has an unmet need for health care, due to long waits, cost or distance to travel.

Surprisingly, only about 30% of New Zealanders have medical insurance. With New Zealand’s publicly funded healthcare system in place, some individuals might feel that additional medical insurance is unnecessary. Not so.

One question to consider is – if you became ill and had to take time off work, how long could you afford?

The public system does take care of acute medical needs, but there are limitations.

Non-acute or diagnostic requirements often lead to waiting lists, leaving individuals in discomfort and uncertainty. Additionally, a significant number of people in need of elective surgery, don’t qualify for public treatment.

Only the highest risk patients with the greatest acuity meet this barrier, resulting in many declined referrals. This leads to follow-up testing and the job of symptom management falls back on our stretched primary care providers.

You don’t have to look far to see the reasons why. Public hospitals are under immense strain due to the chronic hospital specialist workforce shortages. Waiting lists for essential surgeries and specialist appointments are growing. Staff shortages are stretching frontline workers to breaking point.

Like other countries, our ageing population, increasing chronic disease prevalence and resulting growth in demand for acute care, are placing increasing pressure on our health system.

Why Medical Insurance matters now more than ever

Medical insurance gives you the freedom to bypass the public queues and get fast access to private healthcare.

Whether it’s diagnostic scans, consultations with specialists, or elective surgeries, the ability to move quickly can make a critical difference in recovery and treatment. This isn’t just about peace of mind — it’s about preserving your health, your income, and your independence.

Taking out medical insurance provides two significant benefits – financial security and protection of your overall well-being. By securing robust medical insurance, you alleviate stress and uncertainty, which positively impacts your mental and emotional health.

The Cancer Conversation We Can’t Avoid

We can’t talk medical Insurance without having the conversation no one really wants to have. But we need to have it as we are seeing more and more New Zealanders needing access to cancer treatments that aren’t publicly funded.

Many modern cancer drugs — often highly effective and life-extending — fall outside what PHARMAC will cover. The cost of these treatments can run into tens or even hundreds of thousands of dollars.

Having options, when you and your whānau need them most is so important.

The right medical insurance policy will cover you should you need non-Pharmac funded cancer treatments. Without that cover, too many families are forced to either go without or fundraise desperately to get access. Medical insurance is what can make the difference between choices — and no choices.

Protecting Your Whānau Too

This isn’t just about you. Many of our clients choose to extend cover to their families, ensuring their partners and children also get the benefit of private treatment options when they need them most.

With family health often being a major source of stress, medical insurance helps relieve some of that emotional and financial burden.

It’s worth asking yourself this:

- Could I continue to perform at a high level under the stress of long wait times or limited care options?

- Am I relying too heavily on ‘being healthy’ as my only plan?

- Have I considered how illness in my whānau could impact my own availability, energy, and earning power?

- How would it feel to be told the treatment I need isn’t publicly funded — and costs $60,000+?

- What would it cost me — physically, emotionally, and financially — to delay care by weeks or months?

Let’s Have A Conversation

As part of our relationship with Te Korowai, we’re here to provide personal, obligation-free advice to all members. Whether you already have cover and want a review, or you’re just starting to consider it, we’ll help you understand your options and tailor something that works for you and your situation.

You’ve spent your life investing in others — now it’s time to invest in your own health and future.

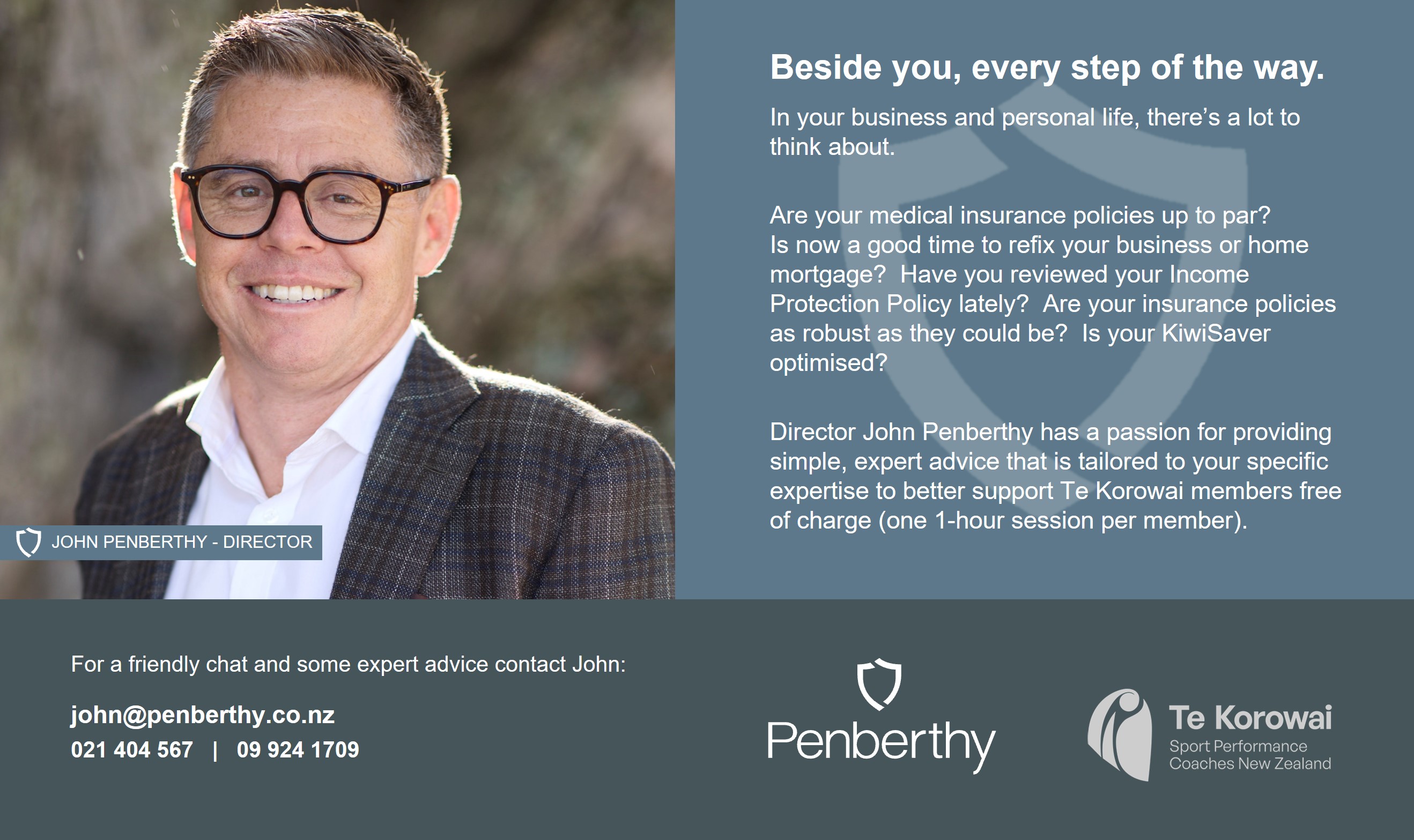

This article has been provided by Penberthy. Our partnership provides our members a free one-hour consultation with Director John Penberthy to discuss any insurance or mortgage-related matters. John offers expert guidance on business and personal insurance and will refer you to our in-house mortgage specialists where appropriate, ensuring you receive tailored, knowledgeable support from the right people.

For a friendly chat and some expert advice contact John Penberthy today. John has a passion for providing simple, expert advice that is tailored to your specific needs. To better support Te Korowai members, you are invited to contact John for a no obligation, free of charge discussion.

021 404 567 | 09 924 1709 | [email protected]