Future proofing your retirement in an uncertain world

Future proofing your retirement in an uncertain world

For those of you with kids at school or in need of the healthcare system, October’s strikes really bought bare the struggles of New Zealand’s fiscal position. We simply can’t afford to increase the pay of our nurses and teachers in line with inflation.

If we can’t afford to pay teachers and nurses, what else is about to be cut? The most talked about programme is superannuation – it is one of the biggest costs for the Government, making up almost 17% of Government expenditure and only expected to grow.

According to Treasury (in their latest long term fiscal report) NZ Super is unsustainable as our population ages and therefore it will need to change. That has real implications for how New Zealanders prepare for retirement. Rather than relying on the Government, people are going to need to do more to look after themselves.

For many, their KiwiSaver investment will make up the bedrock of their retirement plan. KiwiSaver will become the largest and most important investment many Kiwis ever have outside of their family home and therefore they need to get it right.

The tips to building a great KiwiSaver investment plan

- Are you in the right type of fund

Research from KiwiSaver Scheme provider Kōura Wealth showed that almost 50% of Kiwis are in funds not quite right for them. In short, if you are young and have a long wait until you can touch your KiwiSaver investment for your retirement, you need to make sure that you are in an aggressive fund. If you are approaching retirement or about to buy your first home, a balanced or conservative fund might be best for you.

- Are you contributing enough?

The truth is that 3% contribution is not enough for most people. Even if you raise your contribution to 4%, that still only makes a 7% contribution for most people (4% employer and 3% employee contribution) which is not enough. Internationally, the average pension contribution rate is 15%, even Australia has recently moved to 12% as their default rate.

The sooner you start contributing and understand how much you need to contribute, the easier it is to hit your goals. You don’t want to wait until you are 50 and then realise you are short, because it is much harder to catchup at that point in time.

- Are you in a dud fund?

KiwiSaver schemes may appear similar, but they are all slightly different. While you don’t necessarily want to choose a fund because it is the best performing (a fund that does well in one set of market conditions is unlikely to do well when conditions change), there are a few funds which consistently perform worse than the market averages. You want to avoid these funds if possible.

- Invest in what interests you

This is the largest investment you will ever have – you need to be engaged, interested and proud of your KiwiSaver investment. Gone are the days of generic growth, balanced and conservative funds. You can now invest in sustainable funds, or even put a little Bitcoin, Clean Energy or Property into your KiwiSaver plan.

It is up to you to make your own choices about what you want to invest in.

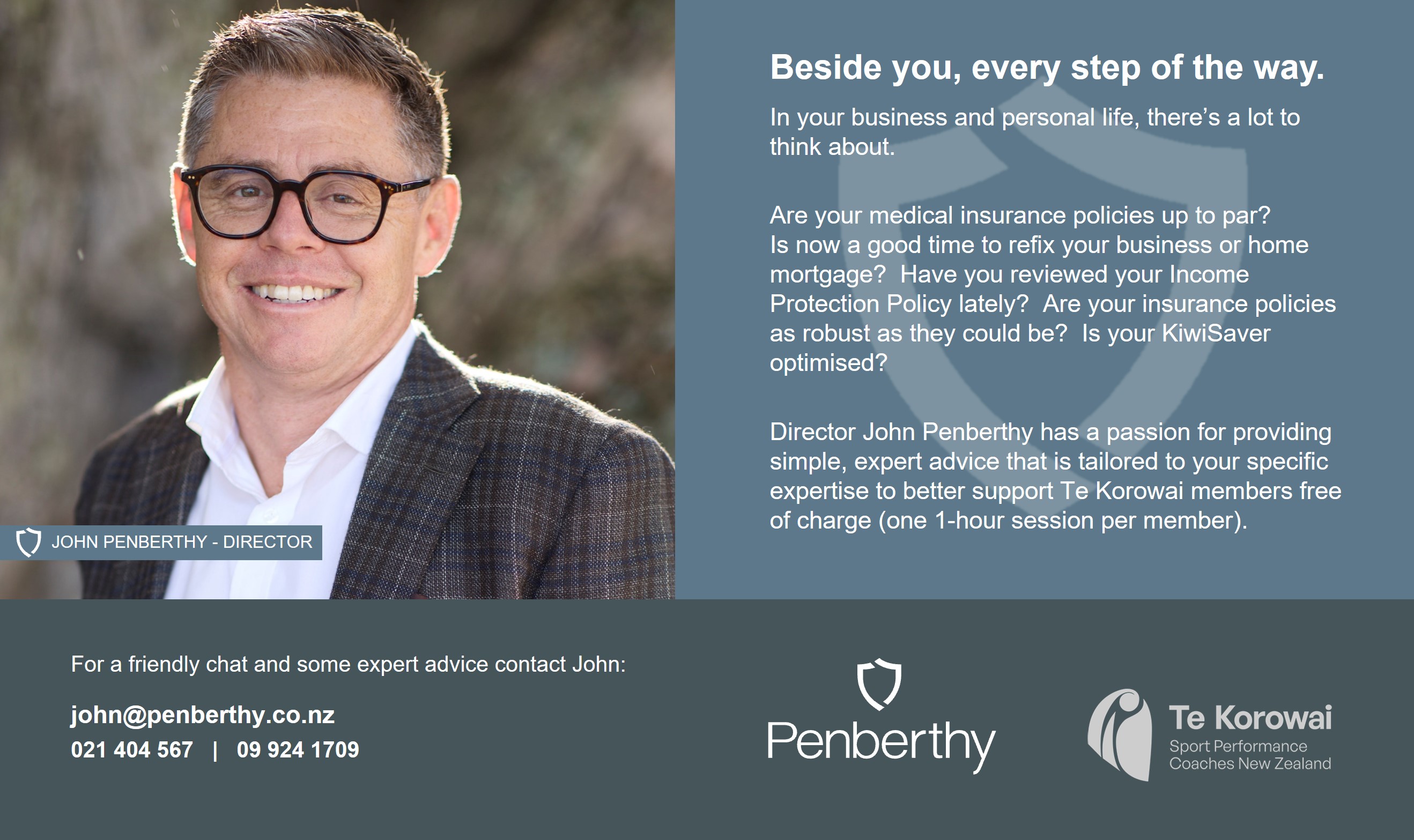

Getting your KiwiSaver investment right is absolutely critical to setting you up for your future, and for many people it can be quite intimidating. Our recommendation is that you sit down with a professional (most likely over Zoom) who can look at your KiwiSaver investment and let you know whether you are making the right decisions, or whether small tweaks might need to be made. If you want someone to review your KiwiSaver investment, get in touch with us here at Penberthy.

*Penberthy works in partnership with Kōura Wealth, our trusted KiwiSaver referral partner and specialists. Any information or guidance on KiwiSaver investments provided through this article is supported by Kōura Wealth’s expertise.

* This content is for informational purposes and should not be considered financial advice. Before making any financial decisions, consider consulting a financial adviser.