New Zealand’s Mortgage Market Update – What Borrowers Should Be Thinking About NowFuture proofing your retirement in an uncertain world

New Zealand’s Mortgage Market Update – What Borrowers Should Be Thinking About NowFuture proofing your retirement in an uncertain world

We’re continuing to see meaningful change across New Zealand’s residential lending market. With interest rates lower than they were a year ago and a large portion of lending due to reprice, now is an opportune time to review whether your mortgage structure is still working as hard as it should.

Here’s our current view of the market.

The Current Mortgage Market

New Zealand’s housing loan book now totals around $389 billion, and a significant proportion of this is either on floating rates or due to come off fixed terms over the next 12 months. In practice, this means a large majority of borrowers will face a rate decision this year, making it an important period for household cashflow planning.

Based on Reserve Bank averages, floating mortgage rates are sitting just under 6%, while 1-year fixed rates are around the low-5% range, with slightly higher pricing forecasted. While advertised “special” rates can be sharper than these averages, the overall picture is that borrowing costs are materially lower than the peak levels seen in 2023 and early 2024.

What’s Driven the Shift in Rates?

The main driver has been the easing in monetary policy.

The Official Cash Rate (OCR) now sits at 2.25%, following a series of cuts from its 2023 peak. The Reserve Bank has been clear that inflation is expected to continue trending lower toward the middle of its target band over 2026, and the reduction in the OCR is intended to support broader economic activity.

Importantly, while rates have already fallen meaningfully, wholesale markets tend to price in expected changes ahead of time. This means mortgage rates may not move one-for-one with future OCR decisions, but the overall rate environment is now considerably more borrower-friendly than it was 12–18 months ago.

What’s Ahead? – Penberthy’s View

We believe there may still be some scope for modest rate reductions, particularly at the shorter end of the fixed-rate spectrum, although much of the easing cycle is now behind us.

At the same time, the housing market remains relatively subdued. For many borrowers, this combination of lower interest rates and softer house prices creates a window of opportunity — whether that’s upgrading a family home, restructuring existing debt, or considering a well-planned investment purchase.

From a lending perspective, competition between banks remains strong. Most major lenders continue to offer cash contributions for new lending and refinances, particularly for first-home buyers and owner-occupiers, with conditions around loan size and minimum time with the bank. These incentives can make a meaningful difference when refinancing or restructuring, provided they’re weighed up alongside interest rates and long-term strategy.

What’s the Prudent Thing To Do?

With so many borrowers approaching a refix, the key takeaway is that there’s no single “right” answer.

For some, locking in certainty with a fixed rate will make sense. Others may benefit from splitting loans across different terms, utilising a revolving credit facility, or using a short-term fixed or floating portion to retain flexibility. In some cases, refinancing to another bank, with the help of a cash contribution, can materially improve overall outcomes.

What matters most is that your mortgage structure aligns with your income, your future plans, and your appetite for risk.

We’re here to assess your current position, talk through what’s coming next, and provide tailored advice that helps you make confident, informed decisions in a changing market.

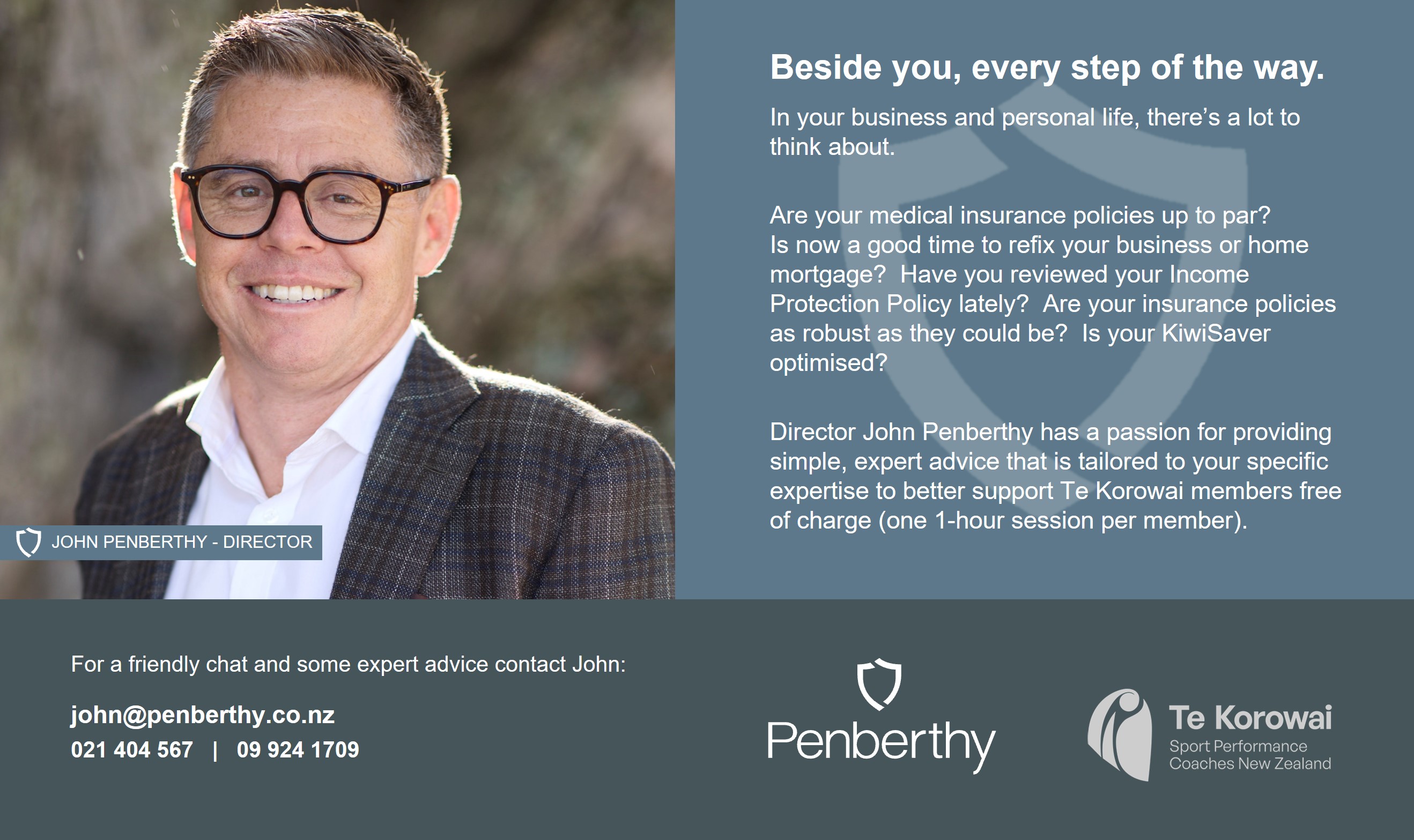

This article comes from Penberthy. Our partnership offers members a free one-hour consultation with Director John Penberthy. John will expertly direct you to the specific specialist within our office who can provide the in-depth advice and sound knowledge you need regarding business or personal insurance and mortgage broking.

For a friendly chat and some expert advice contact John Penberthy today. John has a passion for providing simple, expert advice that is tailored to your specific needs. To better support Te Korowai members, you are invited to contact John for a no obligation, free of charge discussion.

021 404 567 | 09 924 1709 | [email protected]

* This content is for informational purposes and should not be considered financial advice. Before making any financial decisions, consider consulting a financial adviser